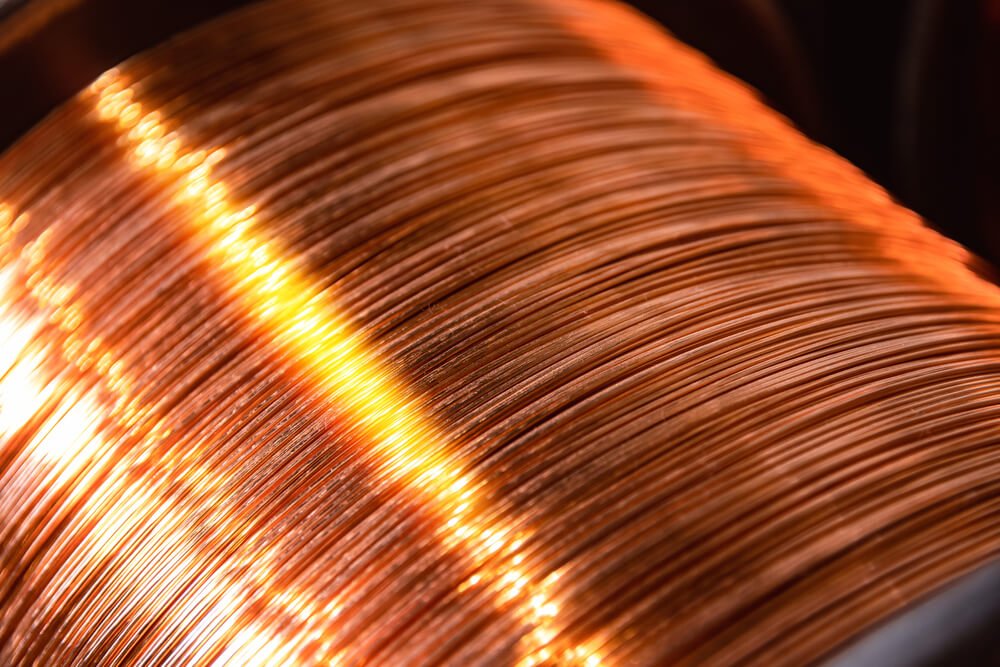

Robust Domestic Market Growth

The year 2023 has been significant for copper demand in India, reflecting the country’s strong economic growth. Despite global headwinds, domestic copper demand has shown remarkable resilience. This robust demand is mirrored in the performance of key players in the Indian copper industry. Hindustan Copper Ltd’s share price nearly doubled over the year, while other major refiners like Hindalco Industries witnessed a share price increase of over 20%.

Global Demand and Price Trends

Globally, copper demand growth remained modest, estimated at around 2% for the year, according to ICRA. Expectations of a boost in demand following China’s post-Covid reopening were unmet, leading to market disappointment. Additionally, rising interest rates and economic slowdown in developed nations have kept copper demand and prices relatively range-bound. The London Metal Exchange recorded only a 1.2% rise in copper prices during 2023.

India’s Strong Economic Outlook and Copper Demand

The domestic outlook remains positive, with the Reserve Bank of India raising the GDP forecast to 7% for FY24, along with a robust growth projection for FY25. The domestic refined copper demand is expected to grow healthily at 11% in FY2024 and FY2025, outstripping global growth rates. This demand is largely driven by the Indian government’s infrastructure push, with about 40% of domestic copper demand stemming from the construction and infrastructure sectors. Additionally, the automobile and consumer durable sectors, accounting for 11-13% of demand each, are also expanding.

Supportive Factors for Demand Growth

The growth in renewable energy conversion and the electric vehicle sector are further bolstering copper demand in India. Jayanta Roy, Senior Vice-President & Group Head of Corporate Sector Ratings at ICRA, highlighted the Indian government’s emphasis on the smart city programme, the defence sector, and the rising penetration of electric vehicles as key drivers of domestic demand.

Copper Smelter Developments and Import Trends

Despite this domestic demand surge, India faces a deficit in refined copper production, leading to increased reliance on imports. Imports of refined copper rose by approximately 30% in FY2023 and about 180% in H1 FY2024. However, the upcoming launch of a new copper smelter by the Adani Group, with a capacity of 0.5 million MT, starting from FY2025, is expected to partially alleviate this deficit.