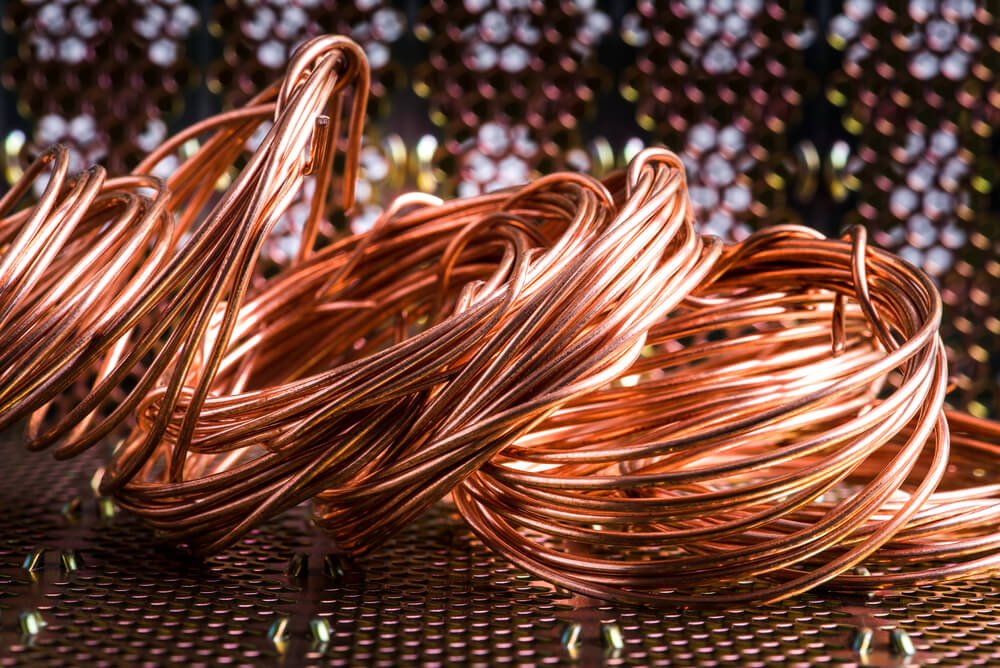

Futures contracts of copper on the London Metal Exchange edged up slightly in early Asian trade today. The rise is driven by expectations that the Federal Reserve will cut interest rates in September, which would likely stimulate economic activity and increase demand for copper.

Additionally, consumption of copper increased by 3.7% year-on-year to 11.16 million tonnes in the January-May period, according to the International Copper Study Group. This has further supported the prices of the industrial metal.

Positive sentiment from India has also contributed to the price support, following the government’s announcement to continue infrastructure spending in its latest Budget.

However, concerns over China’s slowing economic growth, the largest consumer of copper, along with rising inventories, could limit the price gains. Global refined copper production increased by 6.1% year-on-year to 11.57 million tonnes in the same period, which might exert downward pressure on prices. At 0836 IST, the three-month copper contract on the LME was at $9123.00 per tonne, up 0.1% from the previous close.

Gold Prices Climb on Geopolitical Tensions

Gold prices on the COMEX rose in early Asian trade today, driven by rising geopolitical tensions in West Asia. Israeli Prime Minister Benjamin Netanyahu’s recent speech before the US Congress emphasized a decisive victory over Hamas, escalating concerns over the prolonged conflict in Gaza.

Market analyst Samer Hasn from XS.com noted that the ongoing war in Gaza continues to sustain fears of further escalation, thus boosting the attractiveness of gold as a safe-haven asset.

Additionally, the market’s anticipation of the US Federal Reserve starting its rate cut cycle in September, due to slowing inflation and cooling economic growth, has further contributed to gold’s appeal. Lower interest rates typically make non-interest-bearing assets like gold more attractive to investors. At 0804 IST, the most active August gold contract on the COMEX was at $2370.7 per ounce, up 0.7% from the previous close.