Multinational commodity trader and mining group Glencore has finalized the purchase of a 56.25% stake in the Mara copper and gold project in Argentina. This acquisition has been made possible through an agreement with Canada’s Pan American, resulting in Glencore obtaining full ownership of the site. The transaction is set to conclude during Q3, with Glencore making a payment of $475 million to Pan American for the stake. As part of the arrangement, Pan American will also receive a 0.75% copper net smelter return royalty.

Situated in Catamarca Province in northwestern Argentina, the Mara project holds proven and probable mineral reserves amounting to 5.4 million metric tons of copper and 7.4 million ounces of gold within a total of 1.1 billion metric tons of ore. Industry analysts predict that Mara will emerge as one of the top 25 global copper producers upon commencement of operations. Over the initial decade of production, the site is forecasted to achieve an average annual copper production exceeding 200 metric tons.

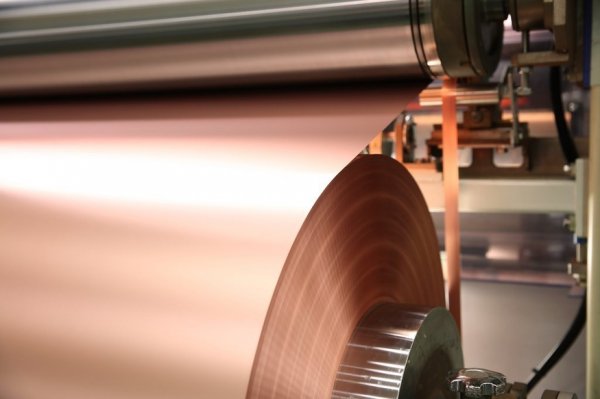

The Mara project is expected to incorporate the Alumbrera concentrator plant, situated approximately 145 kilometers away. Discussions have taken place concerning the potential construction of a conveyor belt linking the mine and the plant, which are separated by a mere 30-kilometer distance.

This acquisition stands as one of several substantial deals that could potentially influence Glencore’s stock performance. In 2020, a partnership between Glencore, Yamana, and the Argentine federal government led to the merger of the Alumbrera concentration plant with the Agua Rica copper mine. Glencore’s acquisition of Newmont’s stake in the joint venture was finalized in October 2022, boosting its ownership to 43.75%. In March 2023, Pan American acquired Yamana Gold’s stake.

Glencore’s acquisition of the Mara project is anticipated to enhance its position within the copper market. The company has also recently made an unsolicited bid for Canadian base metals producer Teck, aiming to establish a dominant presence in the base metal sector.

On July 28, the closing price for copper on the London Metal Exchange was recorded at $8,662.50 per metric ton, reflecting a 4.17% increase compared to the previous month. Pan American simultaneously announced two additional deals alongside the sale of its Mara stake. These include the divestment of its interest in Agua de la Falda to Rio Tinto and the acquisition of Compañia Minera Argentum by its Peruvian subsidiary.

Don’t forget to check out more Mining Industry news!