The anticipated inclusion of copper foil as a designated core mineral within the framework of the Inflation Reduction Act (IRA) by the U.S. government is poised to have noteworthy ramifications for the battery sector. This development is expected to have a particular impact on Korean copper foil manufacturers, as it potentially curtails the entry of Chinese enterprises into the rapidly expanding U.S. battery market.

Insider sources from the battery industry have indicated that additional comprehensive regulations pertaining to the IRA are projected to be unveiled by the U.S. Department of Energy and related entities by October. Industry experts anticipate the forthcoming announcement to feature copper foil’s designation as a core mineral. Notably, the U.S. Department of Energy recently introduced copper as a core mineral for the first time. Given copper’s significance as a primary material for copper foil production, the inclusion of copper foil as a critical mineral within the IRA appears likely.

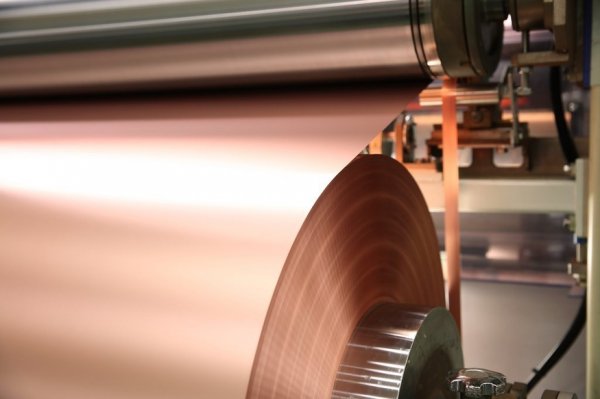

Copper foil plays an indispensable role in the fabrication of cathode materials, constituting one of the key components in battery production. Once bestowed with the classification of a critical mineral under the IRA, the manufacture of copper foil must either occur within the United States or in a nation having a free trade agreement (FTA) with the U.S. This status affords various incentives from the U.S. government. Batteries utilizing this specific type of copper foil are eligible for electric vehicle subsidies of up to $7,500 per vehicle. This is projected to lead to heightened orders for Korean enterprises. Notably, companies such as Lotte Energy Materials, Solus Advanced Materials, and Korea Zinc, recent entrants into the copper foil sector, stand to export copper foil to the U.S. without the obligation to establish production facilities in North America.

Despite the prevailing circumstances, SK Nexilis stands as the lone Korean enterprise to have forged a joint venture with the Toyota Group in North America. This advantage arises due to the company’s eligibility for a tax credit up to 30% of its investment and a 10% tax reduction on production costs. Furthermore, state incentives are expected to enhance the competitiveness of SK Nexilis’ copper foil pricing.

This advantageous position is also expected to yield benefits in terms of reduced logistics costs for transportation to client facilities. Consequently, SK Nexilis is poised to ascend as a prominent supplier of copper foil. Relying on these strategic advantages, SK Nexilis is currently engaged in negotiations with four existing customers and two new clients in the U.S. market for substantial long-term supply agreements. Industry analysts are optimistic about the company securing orders from major players such as Toyota, LG Energy Solution, Samsung SDI, SK Innovation, and various European battery manufacturers. The potential orders are anticipated to amount to as much as 10 trillion won.

Diverging from the dynamics in other battery material markets, the copper foil domain is marked by intense competition involving entities from Korea, China, Taiwan, and Japan. As Chinese enterprises expand their production capabilities to capitalize on favorable electricity and labor costs, concerns about oversupply and price competition in the narrow-width copper foil sector have arisen.

In light of these factors, experts forecast that the entry of Chinese companies into the U.S. market will be limited. This scenario is predicted to pave the way for Korean enterprises to enjoy sustained profitability in the foreseeable future.

The European Union (EU) is currently engaged in discussions with the U.S. government regarding the possibility of obtaining a mineral agreement status akin to a free trade agreement under IRA regulations. Depending on market conditions, SK Nexilis’ Polish facility with an annual capacity of 57,000 tons and Lotte Energy Materials’ Spanish plant with a capacity of 30,000 tons, both set to be operational next year, may also contribute to copper foil exports to North America.

Consider learning more Copper Mining News!