Background on Previous Contracts with Russia:

In previous arrangements before Russia’s invasion of Ukraine, Novelis procured some of its aluminium from Russia’s Rusal. However, since the conflict, the company has refrained from entering new contracts for Russian aluminium, a decision confirmed by the firm’s CEO last August.

Statement from Novelis Europe’s President:

Emilio Braghi, the executive vice president and president of Novelis Europe, in an interview at the London Metals Exchange (LME) Week, commented, “Though Novelis Europe still has some ongoing contract commitments with Russian aluminium suppliers, we’ve decided to exclude Russian aluminium sources from our 2024 tender.”

Global Outlook and Rusal’s Position:

Despite there being no formal sanctions on Russian metal, a significant portion of consumers are hesitant to buy aluminium from Rusal, which is responsible for 6% of the global aluminium mining output.

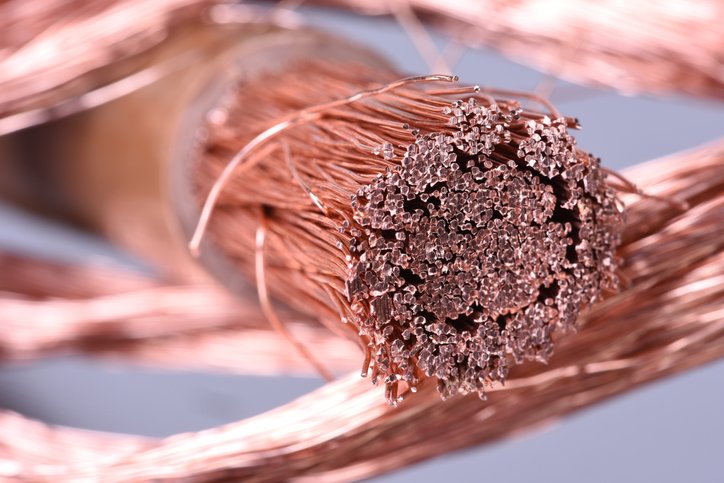

Novelis’s Role in the Aluminium Industry:

Novelis, a subsidiary of India’s Hindalco Industries, is also globally recognized as the premier aluminium recycler, boasting both production and recycling operations throughout Europe.

Trends in Aluminium Usage:

The push for reduced plastic packaging, owing to environmental concerns, has resulted in growing demand for aluminium-based packaging. According to Braghi, there’s a rising trend favoring aluminium in beverage packaging, particularly for sodas and beers. The surge in popularity of energy drinks and canned cocktails further fuels this demand.

Legislation and Consumer Preferences:

Several countries introducing more stringent packaging legislation, coupled with changing consumer preferences that lean away from plastics, have bolstered the switch to aluminium cans.

Impact on the Aerospace and EV Sector:

He continued, “The sales of aluminium are also positively influenced by the escalating growth in electric vehicles. Moreover, in the aerospace sector, there is a substantial recovery ongoing after the slump caused by the COVID-19 pandemic.”

Challenges in the Building and Construction Segment:

Despite these positive trends, not everything is rosy. Novelis’s production sites are working at almost full capacity, but assets catering to the building and construction segment face challenges. This segment’s growth is hindered by mounting interest rates, escalating labor costs, and general supply constraints resulting in market instability.

Effects of Previous Production Cuts:

Braghi highlighted that the previous year’s aluminium production cuts in Europe, triggered by soaring energy prices, are still in effect. He concluded, “In the short term, these production reductions in Europe have caused an inclination towards increased aluminium imports, even though the demand remains only moderately high.”