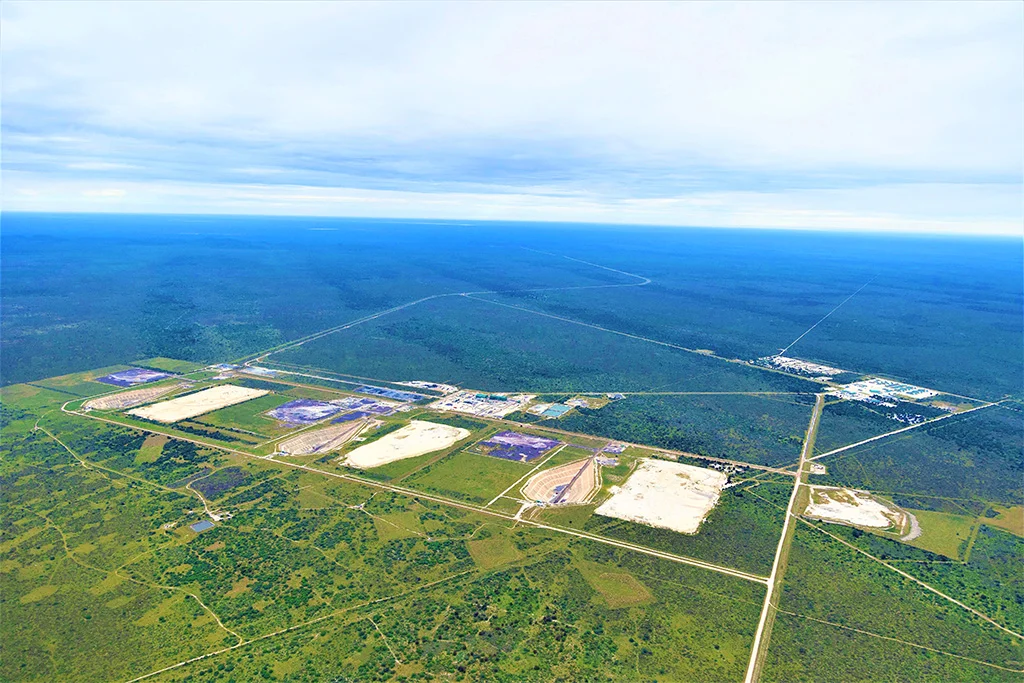

Australian mining company South32 has reportedly enlisted RBC Capital, a Canadian global investment bank, to oversee the acquisition of Botswana’s Khoemacau copper project, according to sources cited by the Financial Review. The project is owned and operated by Cupric Canyon Capital, a subsidiary of Global Natural Resource Investments (GNRI), and began production in 2021. Situated in northern Botswana, the Khoemacau copper project has an annual production capacity of 60,000 tonnes of copper and 1.6 million ounces of silver. GNRI has been exploring the sale of the project since April 2022. The initial estimated purchase value was over $1.5 billion (A$2.24 billion), but it may have changed due to recent fluctuations in global copper prices. Cupric secured $565 million in funding in early 2019 to complete the project.

South32 made a profit in the 2022 fiscal year after incurring a loss in the previous year. Increased aluminium prices meant the company made a $2.67bn profit after tax. The company’s portfolio had shifted “toward metals critical for a low-carbon future”, CEO Graham Kerr stated at the time. Kerr also said the company expected its copper equivalent production to increase by 14%, with $1.2bn of capital expenditure planned.

South32 currently operates a trio of locations in nearby South Africa and Mozambique, although these are not copper focused but rather centred on aluminium and manganese.

In February 2022, the company acquired its first copper operation, purchasing a 45% stake in the Sierra Gorda copper mine in Chile. The project produced 25,300t in 2022.

“With the expected grade and reserve decline of existing copper mines from 2027, new mine supply will be important to close the demand supply gap,” South32 says on its website. This could indicate the reasoning behind the potential Botswana purchase.

Also interesting: A shortage of copper foil will drive up prices for the red metal – learn more in a review by Metals Wire expert