Ivanhoe Mines’ impressive copper production in the Congo was paralleled by Nickel 28 Capital’s robust output in Papua New Guinea, signaling strong market resilience. Meanwhile, Conexus Resources Group’s inauguration of a major aluminium rod facility in Bahrain marked a significant stride in the Middle East’s manufacturing landscape. Spain, however, grappled with environmental challenges in its mining surge, epitomized by the contentious lithium project in Cáceres. In Africa, Zambia’s KCM is on the cusp of a much-anticipated operational restart, promising to revitalize the nation’s copper sector. Capping off these developments, Aterian’s strategic foray into Botswana’s lithium sphere with the acquisition of Atlantis Metals showcases the industry’s adaptive response to the burgeoning demand for energy transition materials, reflecting a dynamic interplay of innovation, environmental stewardship, and economic imperatives in the world of metals and mining.

Ivanhoe Mines: Strong Copper Output in 2023, Growth Expected in 2024

Ivanhoe Mines announced its 2023 production figures, with 393,551 tonnes of copper from its Kamoa-Kakula complex in the Democratic Republic of the Congo, meeting its yearly guidance and marking an 18% increase from the previous year.

Looking ahead, the company forecasts a rise in production for 2024, estimating between 440,000 and 490,000 tonnes. This increase aligns with the completion of their phase 3 concentrator.

Addressing power challenges, Ivanhoe Mines is enhancing grid stability in collaboration with SNEL. The company also plans to release its 2023 financial results on February 26, 2024, ensuring compliance with National Instrument 43-101 standards.

Nickel 28 Reports High Production at Ramu in 2023, Plans Upgrades in 2024

Nickel 28 Capital announced that its Ramu nickel-cobalt operation in Papua New Guinea produced 33,604 tonnes of nickel and 3,072 tonnes of cobalt in 2023, surpassing its capacity for the seventh consecutive year. The company holds an 8.56% joint venture interest in Ramu, operated by Metallurgical Corp. of China (MCC).

For 2024, MCC plans a $33 million capital upgrade at Ramu, including a 30-day plant shutdown in September. This is expected to result in approximately 30,000 tonnes of nickel and 2,700 tonnes of cobalt production. The upgrades aim to enhance equipment performance and phase out outdated equipment.

Despite challenges from multiple earthquakes in 2023, Nickel 28 CEO Anthony Milewski commended the operation’s resilience. The 2023 production aligns with the guidance of 33,000 tonnes of nickel. The company is also focused on electric vehicle market exposure through its joint venture and a portfolio of nickel and cobalt royalties.

Conexus Unveils $100M Aluminium Rod Facility in Bahrain

UK-based Conexus Resources Group has inaugurated a $100 million aluminium rod plant in Bahrain, with an annual output capacity of 32,000 metric tonnes. The facility, named Konexus Aluminium, will transform liquid aluminium from Bahrain’s national manufacturer, Alba, into high-quality rods for global markets.

This development reinforces Bahrain’s position as a manufacturing and export hub, particularly in the aluminium sector, which is a key part of the country’s non-oil economy and Economic Recovery Plan. Bahrain offers a business-friendly environment with favorable policies for manufacturing companies.

The inauguration of Konexus Aluminium marks a significant step in expanding Bahrain’s industrial capabilities and global reach in the aluminium industry.

Rising Metal Mining in Spain Faces Environmental Hurdles

Spain’s surge in metal mining projects, essential for the energy and digital transition, is encountering environmental and social resistance. About 30 projects, including Infinity Lithium’s lithium extraction plan in Cáceres, are facing opposition due to their potential ecological impact.

The Cáceres project, initially an open-air mine, was rejected due to urban planning constraints. The company now proposes a subway gallery mine to mitigate environmental concerns, promising renewable energy use and wastewater recycling. However, local groups like Salvemos la Montaña de Cáceres oppose the project, citing pollution and resource consumption issues.

Spain, rich in mineral resources, is experiencing increased interest in dormant mines due to rising metal prices. However, many projects struggle to pass environmental assessments. For instance, the Matamulas rare earth project in Ciudad Real was denied due to biodiversity concerns.

The debate extends to the adequacy of restoration efforts for old mining sites, with critics arguing for higher sureties to ensure proper environmental regeneration. This tension reflects the broader challenge of balancing the demand for critical metals for the energy transition with environmental preservation.

Resumption of KCM Operations in Zambia Expected Soon

Zambia’s Mines Minister Paul Kabuswe has indicated that operations at Konkola Copper Mines (KCM) are set to resume following legal and administrative preparations. This announcement comes in response to union protests demanding the restart of KCM production and the payment of their salaries.

The government and Vedanta Resources have reportedly completed the necessary steps for the mine’s operation to recommence, with the court’s process to remove the KCM liquidator underway. Vedanta, set to retake control of KCM, has committed to investing a significant sum over five years and increasing salaries by 20%.

This development is crucial for Zambia’s copper industry, which experienced production declines in 2022 and 2023 due to issues at KCM and Mopani Copper Mines. The anticipated resumption of KCM’s operations could mark a positive turnaround for the sector.

Nickel 28 Reports Robust Production at Ramu, Plans Upgrades for 2024

Nickel 28 Capital Corp. announced its 2023 production results from the Ramu Nickel-Cobalt operation in Papua New Guinea, exceeding its design capacity for the seventh consecutive year. Ramu, in which Nickel 28 holds an 8.56% joint venture interest, produced 33,604 tonnes of nickel and 3,072 tonnes of cobalt last year.

Looking ahead to 2024, the company expects a production of approximately 30,000 tonnes of nickel and 2,700 tonnes of cobalt, as Metallurgical Corporation of China (MCC) undertakes a US$33 million capital upgrade at Ramu. These upgrades, focusing on improving equipment performance and replacing outdated machinery, are anticipated to enhance future production efficiency.

Despite challenges such as multiple earthquakes in 2023, CEO Anthony Milewski commended the operation’s resilience. Nickel 28, apart from its stake in Ramu, also manages a portfolio of nickel and cobalt royalties on various projects, positioning itself strategically in the electric vehicle market.

Aterian Expands into Lithium Market in Botswana with Atlantis Metals Acquisition

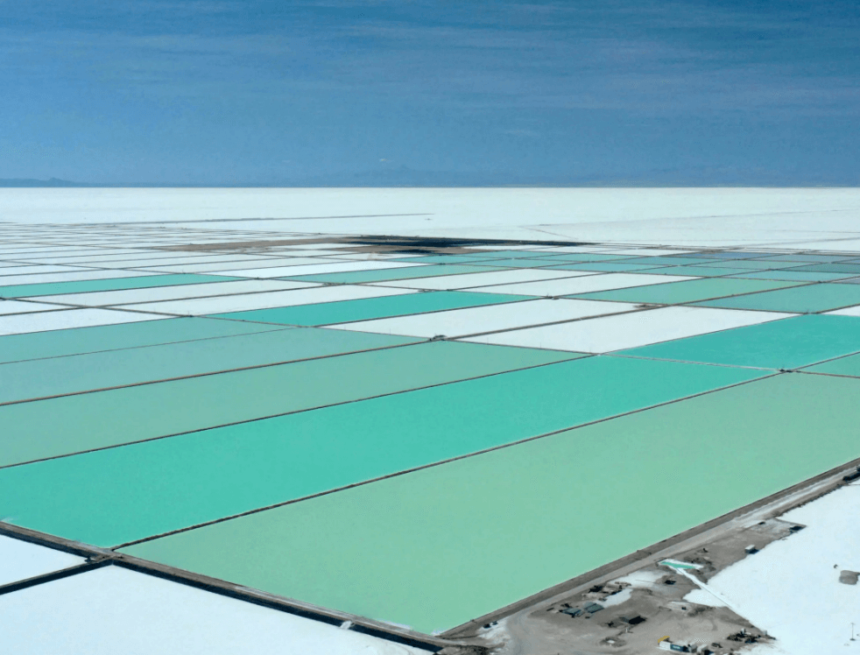

British mining company Aterian, primarily engaged in African copper mining, is entering the lithium business in Botswana. The London-based firm announced the acquisition of a 90% stake in Atlantis Metals, a company owned by a Botswanan geologist, on January 8.

Atlantis Metals holds exploration licenses for lithium brine in Botswana, covering 2,517 km² along the eastern and southern banks of Sua Pan in the Makgadikgadi salt marshes, a region designated as a “lithium zone” by the Botswana Ministry of Mines in 2022. The company also possesses a copper exploration license over an area of 999 km².

The acquisition, costing Aterian a minimum of $80,000 including exploration expenses, is part of Aterian’s strategic expansion into lithium, complementing their existing copper ventures in Botswana and Morocco. The Botswanan geologist will retain a 10% stake in Atlantis and provide management and exploration services for at least 12 months. The deal is subject to regulatory approvals and positive due diligence.

This move by Aterian follows their involvement in Rwanda’s lithium sector, where they hold a significant stake in Kinunga Mining and a partnership with Rio Tinto for the promising HCK lithium project.