Aurubis prepares for lower copper demand

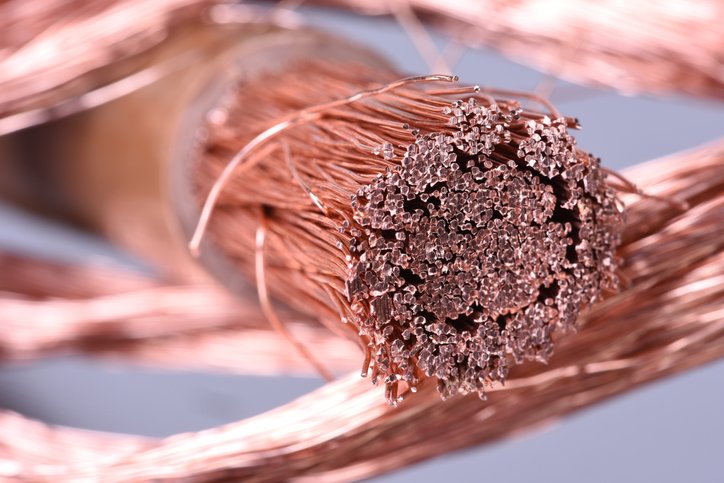

Next year we should expect a lower level of demand for copper. The metal is used in various industries and construction. This is supported by the fact that the European metallurgical giant Aurubis notified its customers that it will set a $228 per tonne premium for copper in 2024.

Currently, copper prices on the London Metal Exchange are trading between $7,812 and $7,885 per ton. They are down more than 10% compared with August and even more so compared to March 2022, when the red metal was trading at around $10,052 per ton.

Carbon tax reshapes European steel industry

The European Union will soon introduce a carbon dioxide tax, based on the amount of emissions generated by various sectors.

One of these sectors will definitely be the metallurgical industry of the Old World, which is characterized by a significant amount of carbon dioxide emissions. These include the copper and aluminum industries, where carbon dioxide is produced during the processing of raw ore materials.

With the new tax, European Union authorities hope to encourage governments in its member states to reduce carbon dioxide emissions and to protect local steel mills from competing with producers in countries with lower carbon dioxide emission limits.

AGMK stockpiles cash to boost production

Almalyk Mining and Metallurgical Combine (AGMK, Uzbekistan) has received a $2.55 billion loan from KfW-IPEX Bank, which it intends to use to increase its manufacturing capacity.

While there is no official word on what specific investment projects this money will be spent on, it is expected that some of the funds will go towards the ongoing project to build a third copper ore processing plant.

This project will allow AGMK to increase the volume of copper ore processing to 160 million tons per year, which will allow the company to increase the production of copper cathodes to 400 thousand tons per year in the future. For comparison, by the end of 2022 the Almalyk Mining and Metallurgical Combine will produce 148.5 thousand tons of copper.

World Zinc Prices Expected to Remain Stable

Zinc prices on the London Metal Exchange are now at their lowest level for the last eighteen months, at $2,455 per ton. The decline observed between January and September of this year was caused by a drop in demand from China (the world’s largest consumer of zinc) and the ongoing crisis in the construction sector, which uses a lot of zinc-coated flat steel products.

However, there are already predictions that there will be no further decline in global zinc prices at least until the end of this year and even over the next few years. For example, BMI expects the average zinc price in 2024-2027 to be around $2,150 thousand per ton.

These estimates are based on expectations of reduced zinc production in the European Union and Australia due to high energy costs and the expected recovery of the Chinese economy from severe quarantine restrictions related to the 2020 coronavirus pandemic.

Alcoa’s Spanish Problem

Alcoa, the US-based company, has not been able to solve the issue of supplying its smelters with cheap electricity or obtaining significant discounts from its suppliers.

As a result, the company announced a temporary shutdown of the foundry at its San Cibrao smelter in Spain. It cited high electricity costs and a decline in customer orders. This decision has caused a storm of indignation among the company’s union committee members, who are now forced to consider retaliatory measures to prevent the foundry workers from being laid off, even though they are officially on forced leave.

Vale sets ambitious goal

Brazilian mining and metallurgical company Vale wants to triple its copper production to 1 million tons per year. Vale also plans to double its nickel production.

The volume of possible investments to achieve such an ambitious task is estimated to be in the range of 25-30 billion dollars over the next 10-15 years. Some projects will be implemented in Brazil, others in Canada and others in Indonesia, where there are large undeveloped deposits of copper and nickel.

In Indonesia in particular, Vale plans to invest $10 billion in developing local laterite deposits and building facilities to process the ore. It is currently building two high-pressure acid leaching plants for nickel ore with China’s Zhejiang Huayou Cobalt.

Vale is also exploring a deposit in Indonesia that could hold copper reserves comparable to the famous Grasberg deposit, developed by Freeport McMoran of the United States.

Vale’s ambitions are also assumed to be related to the signing of a contract with Tesla to supply the carmaker with nickel for the production of lithium-ion batteries for its electric cars. But in this case, the nickel will come from Canada.

Forecast: Global copper production will continue to grow

Judging by the plans of Vale and Almalyk Mining and Metallurgical Plant, as well as the projects of other players, we can expect global copper production to increase to 23.5-23.9 million tons in 2024 and at least 28 million tons in 2030. The growth driver will be the development of “green” energy and transportation, especially the production of electric vehicles: the amount of copper in an electric vehicle amounts to about 100 kg.

This will of course put pressure on global copper prices, but the low price period is not expected to last longer than through 2024, and in 2025 we can expect prices to rise on the back of a recovery in the global economy, which is currently experiencing a downturn due to the high cost of copper and other factors.