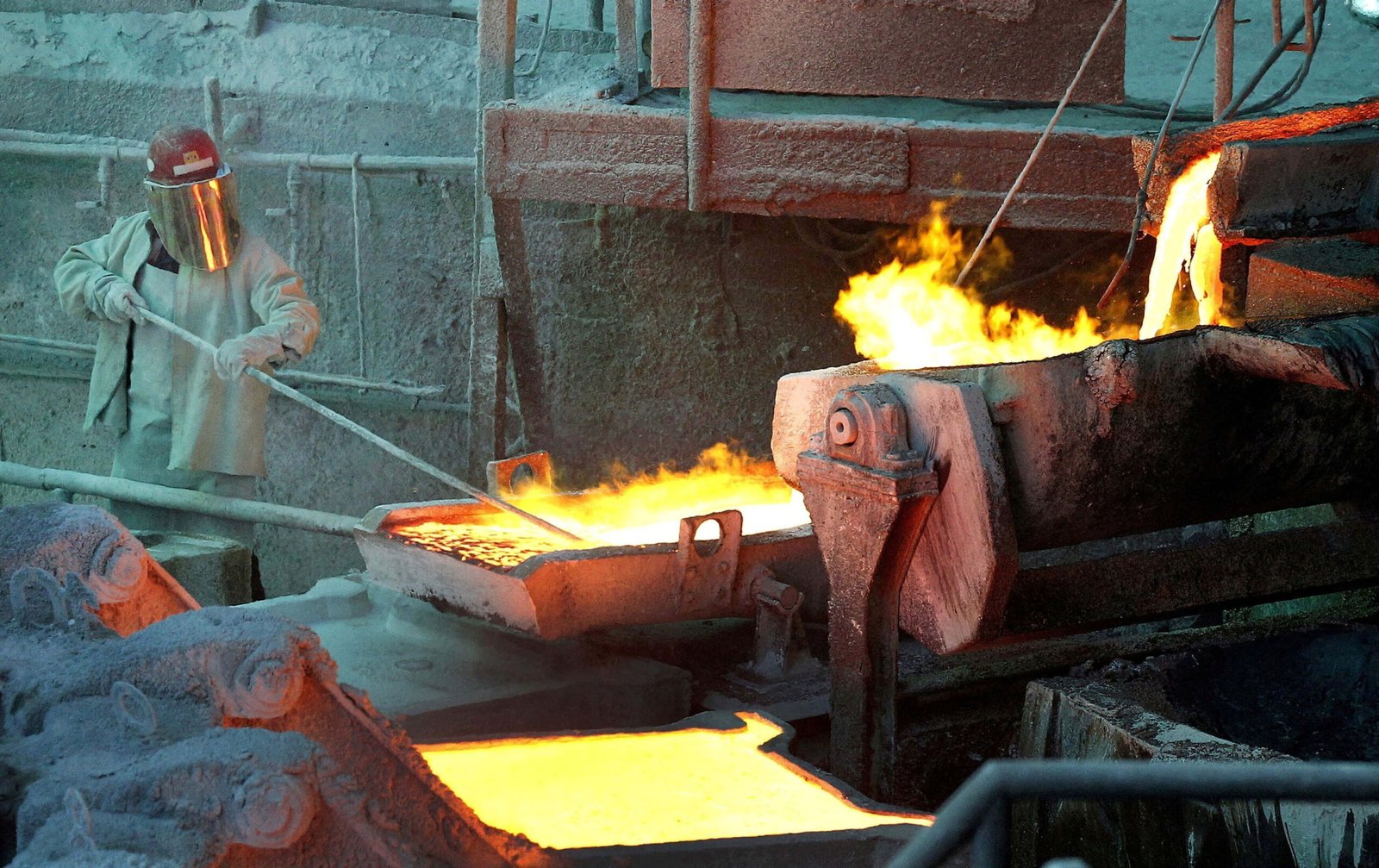

China’s Copper Smelters Face Margin Squeeze Amid Tight Raw Material Supply

China's copper smelters, which produce half of the world's refined copper, are experiencing a tightening of margins due to increased competition for mined copper supplies. This intensified competition is affecting the sector, but significant output cuts that could tighten the metal market are deemed unlikely.

Mostly state-owned, Chinese copper producers are under pressure to maintain or even raise their production targets to support growth in the world's second-largest economy. This challenge comes amid disruptions in copper concentrate supplies due to incidents like the closure of First Quantum's Cobre mine in Panama and Anglo American's reduced production guidance.

Chinese smelters have had to contend with a reduction in treatment charges (TCs), fees for converting concentrate into refined copper. According to Fastmarkets data, TCs have been cut by nearly a third in the past month. As a result, TCs in China fell to $48.2 per metric ton on January 5, the lowest since July 2021, and are 40% below the annual benchmark of $80 a ton.

Some Chinese smelters are considering reducing refined copper production in the second quarter, although details about the quantities involved remain unspecified. Analyst Craig Lang from CRU Group suggests that smaller, higher-cost smelters reliant on spot concentrate purchases might reduce or halt production in the coming months.

Factors Influencing TCs Decline

The decrease in TCs is partly attributed to the expansion in smelting capacity, indicating a greater demand for concentrates. Additionally, China's refined copper output in the first 11 months of 2023 surged by 13% year-on-year to 11.8 million tons. Wood Mackenzie analyst Emily Brugge notes that primary smelting capacity is expected to increase by almost 5% this year, with significant projects in China, Indonesia, and India.