Goldman Sachs Predicts Increasing Copper Demand Fueled by Electric Vehicles

According to Goldman Sachs, the growing adoption of electric vehicles (EVs) serves as a significant driver for the bullish outlook on copper. The bank forecasts that copper demand from the EV sector will reach 1 million tonnes (mt) this year and rise to 1.5 mt by 2025.

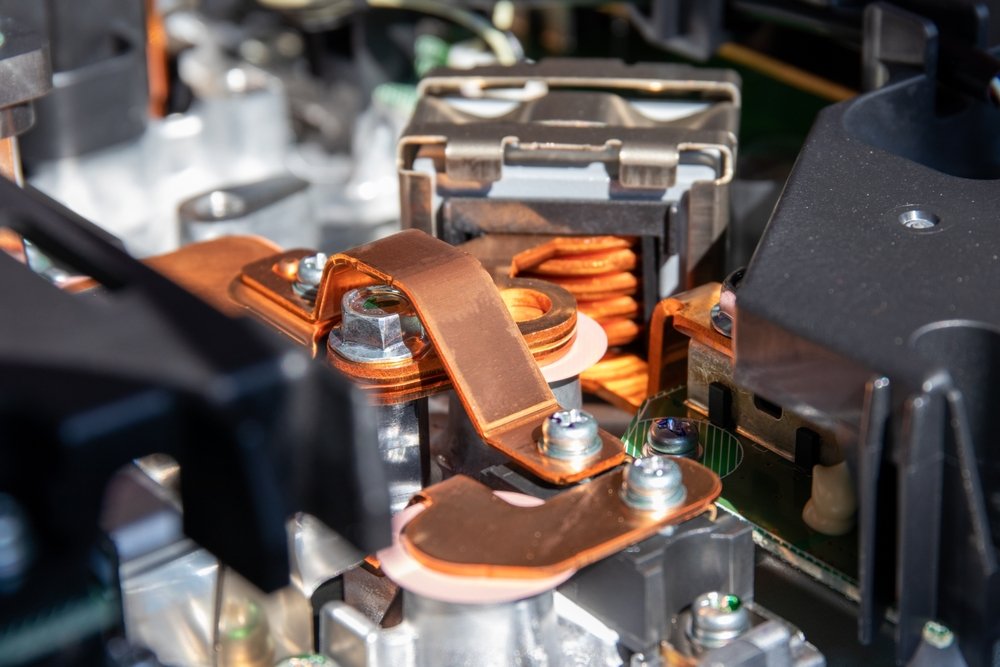

In a recent note, Goldman Sachs highlighted copper's exceptional conductivity and malleability, making it an ideal material for the transformation and transmission of electrical energy in EVs. Notably, EV production accounted for about two-thirds of the global copper demand increase last year, and it is expected to contribute to approximately 27% of additional copper consumption over the next decade.

The bank's analysts expressed optimism regarding the EV market, particularly in China, where they anticipate robust sales driven by lower prices and a strong demand that has been steadily building up throughout 2023.

Despite the positive outlook, copper prices on the London Metal Exchange (LME) experienced a 7.5% decline in the second quarter of 2023 due to a sluggish recovery in demand from China and concerns surrounding global economic growth.

Looking ahead, Goldman Sachs suggests that the amount of copper utilized in each EV may decrease in the long term. By 2030, the bank estimates that the quantity of copper per vehicle is likely to decrease to 65 kg per unit, compared to 73 kg in 2022. This reduction may be attributed to ongoing advancements in EV technology and design, as well as improvements in efficiency.

Goldman Sachs' forecast indicates a positive trajectory for copper demand driven by the increasing popularity of EVs. However, the expected reduction in copper usage per vehicle over time reflects the industry's ongoing efforts to optimize materials and enhance efficiency in EV production.

May also be interesting: "Mining for innovation: the R&D structures of steel companies at work."