Impala Platinum Revises Spending Amid Falling Metal Prices

PGM Prices Navigate Rough Waters

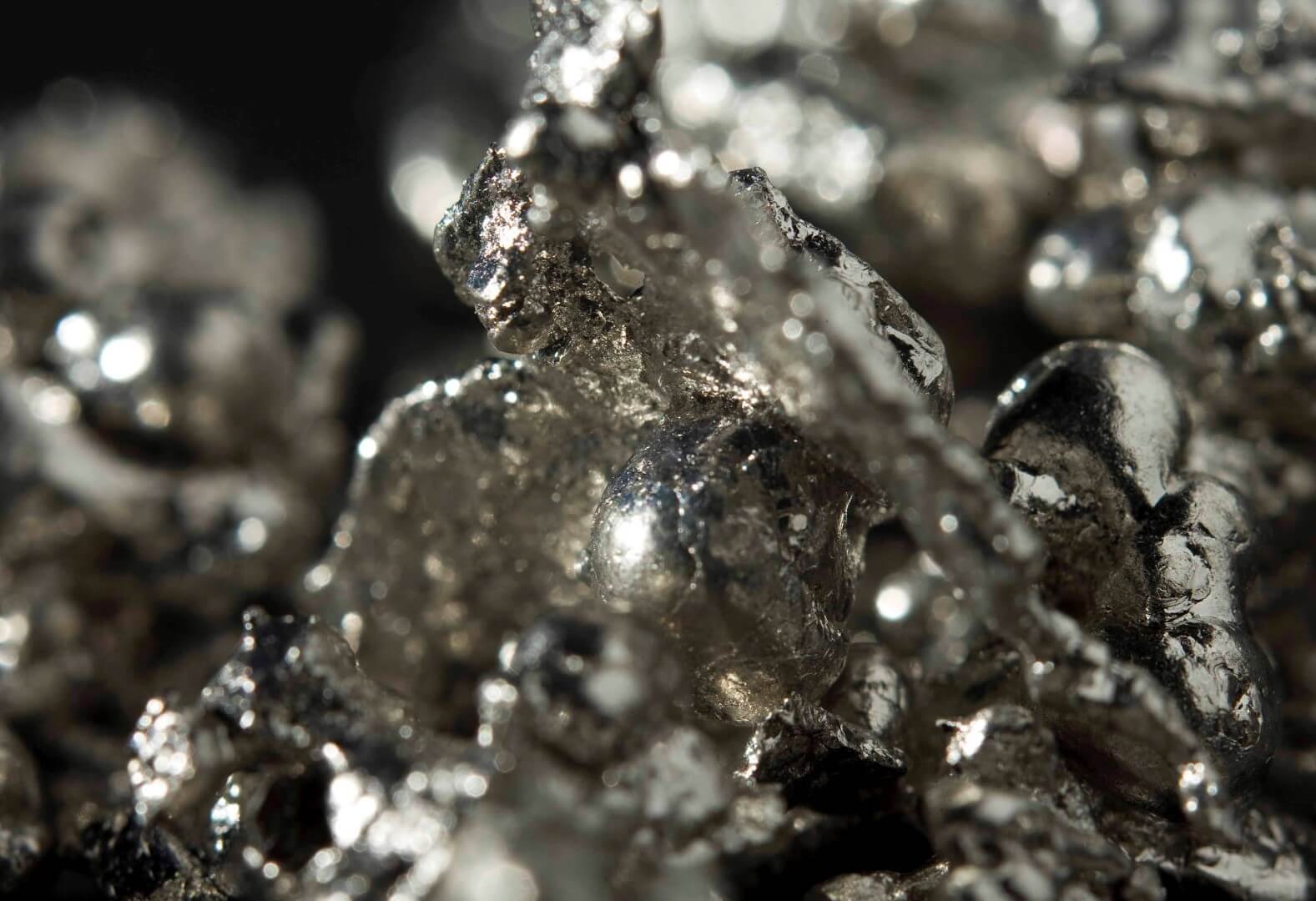

South African mining powerhouse, Impala Platinum, is reconfiguring its planned expenditures due to the recent drop in platinum group metals (PGM) prices. PGMs are integral to the auto industry for their use in catalytic converters, crucial for curbing harmful emissions. However, this year has been challenging with a significant decline in these metal prices, presenting additional challenges to miners that already face towering operational costs.

Market Dynamics at a Glance

Several factors have influenced the prices of PGMs:

- A decline of approximately 15% in platinum prices this year is largely attributed to concerns over global economic growth.

- After reaching a zenith of more than $3,000 an ounce last March, following Russia's foray into Ukraine, palladium now stands at about $1,127 an ounce.

- Rhodium, renowned for its rarity and resistance to corrosion, skyrocketed to nearly $30,000 an ounce in 2021 but has since dived to around $4,500.

Past Commitments and Upcoming Endeavors

Ranked as the world's second-largest PGM producer, right behind Anglo American Platinum, Impala Platinum had previously disclosed a five-year capital investment plan amounting to R50 billion (approximately $2.65 billion USD). This fund was largely designated for enhancements in mining, overhauls, processing infrastructure, and the integration of solar power at Zimplats in Zimbabwe, where Impala Platinum has an 87% stake.

Adjustments in Line with Current Realities

In a recent quarterly production update, Nico Muller, Implats CEO, highlighted, "Planned elevated levels of spend across the portfolio will be adjusted to reflect the prevailing current reality of compressed industry margins." The company has yet to provide specific details regarding which projects might undergo altered expenditures.