Nickel surplus increases in 2023 as Indonesian production rises

The global nickel supply is expected to face a larger surplus this year as more Indonesian smelters, catering to the electric vehicle (EV) battery and stainless steel industries, come online. This surplus threatens to keep nickel prices below the record highs witnessed in 2022.

In the previous year, nickel prices reached unprecedented levels due to factors such as Russia's invasion of Ukraine, which disrupted supply, and the increasing demand for high-purity nickel known as Class 1 nickel, used in EV batteries. Class 1 nickel has higher purity compared to Class 2 nickel, which is commonly used in stainless steel production.

However, starting in 2022, nickel production began to outpace demand once again. Chinese-backed smelters in Indonesia significantly increased their output of nickel pig iron and ferronickel, which serve as feedstocks in stainless steel production. At the same time, the global economy experienced a slowdown, resulting in muted demand for stainless steel. These factors contributed to the surplus in nickel supply and put downward pressure on prices.

As a result, despite the previous record highs, the ongoing increase in Indonesian nickel production and weaker stainless steel demand are expected to keep nickel prices from reaching similar levels in the near future.

The market is "heading for a larger surplus in 2023" and "will not see a deficit before 2028," Ellie Wang, Shanghai-based analyst at consultancy CRU Group, told the Indonesia Miner conference last week.

Wang noted that global stainless steel production fell for the sixth consecutive quarter from January to March amid China's slow economic recovery. EV sales are also slowing so far this year after the Chinese government ended its EV subsidy policy on Dec. 31. China is the world's largest producer and consumer of stainless steel, EVs and batteries.

But with China's EV sales expected to recover in the second half of 2023, nickel demand will pick up and reach 4.3 million tonnes by 2027, up from just below 3 million tonnes last year, with the battery industry replacing stainless steel as the biggest driver of demand, she said.

CRU has forecast the benchmark three-month nickel contract on the London Metal Exchange to average around $23,700 per tonne this year from about $25,600 per tonne in 2022, and to steadily decline to below $20,000 per tonne in 2026, which "remain[s] above historical levels," Wang said.

Nickel smelters have proliferated in Indonesia since the government imposed a permanent ban on nickel ore exports in January 2020 in a drive to build the domestic processing industry and move up the value chain. Indonesia is tied with Australia as home to the world's largest reserves of nickel, each holding a fifth of global reserves.

Tens of billions of dollars of investments have since been made in Indonesia's nickel smelter sector, led by China but also a growing number of other countries. Most recently, the Indonesian government announced a $9 billion investment plan covering nickel mining to battery cell development by a consortium of companies -- including Swiss commodities trader Glencore, Belgian battery materials producer Umicore and Indonesian state miner Aneka Tambang.

The number of nickel smelters in Indonesia has jumped from just 15 in 2018 to 62 as of April, according to Meidy Katrin Lengkey, secretary general of the Indonesian Nickel Miners Association, or APNI. And many more are on the way, as about 30 smelters are under construction and 50 are in planning stages, Lengkey said.

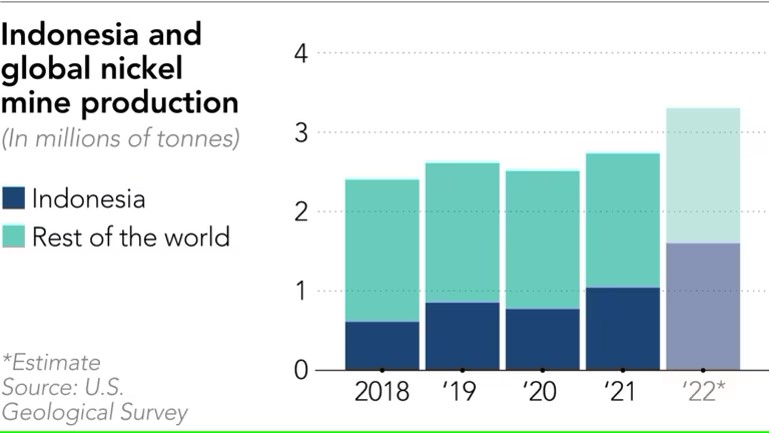

Subsequently, Indonesia's nickel mine production hit an estimated 1.6 million tonnes last year, up 54% from 2021, according to the U.S. Geological Survey. That makes up nearly half of global nickel production that totaled an estimated 3.3 million tonnes.

Jim Lennon, senior commodity consultant at Macquarie Group, said Indonesia's planned total annual nickel production capacity currently exceeds 5 million tonnes. From 2022 to 2029, Indonesia's nickel production will account for more than 75% of the global supply, he said at the SMM 2023 Indonesia Nickel and Cobalt Industry Chain Conference in Shanghai in late May.

Considering the underutilization of nickel production capacity in Indonesia, the market may continue to be in surplus in the next five years, Lennon added.

Learn more about nickel highlights of 2022 and forecast for 2023