Barrick Gold Reports Q3 Results

Barrick Gold shared its preliminary Q3 figures, revealing sales of 1.03 million ounces of gold and 101 million pounds of copper. The company's Q3 production amounted to 1.04 million ounces of gold and 112 million pounds of copper. Despite this uptick in production from Q2, the results fell below the quarter's initial projections, primarily because of setbacks at Pueblo Viejo due to equipment design issues. However, the corporation anticipates a substantial surge in production volume for the fourth quarter.

For context, the average market price for gold in Q3 stood at $1,928 per ounce, and for copper, it was $3.79 per pound.

Several factors contributed to the higher Q3 gold production compared to Q2. Key contributors included increased production at Cortez due to more output from the Crossroads open pit and Cortez Hills underground. Additionally, Turquoise Ridge saw higher production figures, benefiting from previously scheduled autoclave maintenance. Kibali also chipped in with enhanced grades. Nonetheless, these gains were somewhat offset by Carlin's reduced production, which arose from lower grades tied to an uptick in processed stockpiled ore. When compared with Q2, the gold cost of sales per ounce for Q3 is projected to decrease by 2% to 4%, with total cash costs per ounce likely dropping by 4% to 6%. Meanwhile, all-in sustaining costs per ounce are anticipated to be 6% to 8% lower.

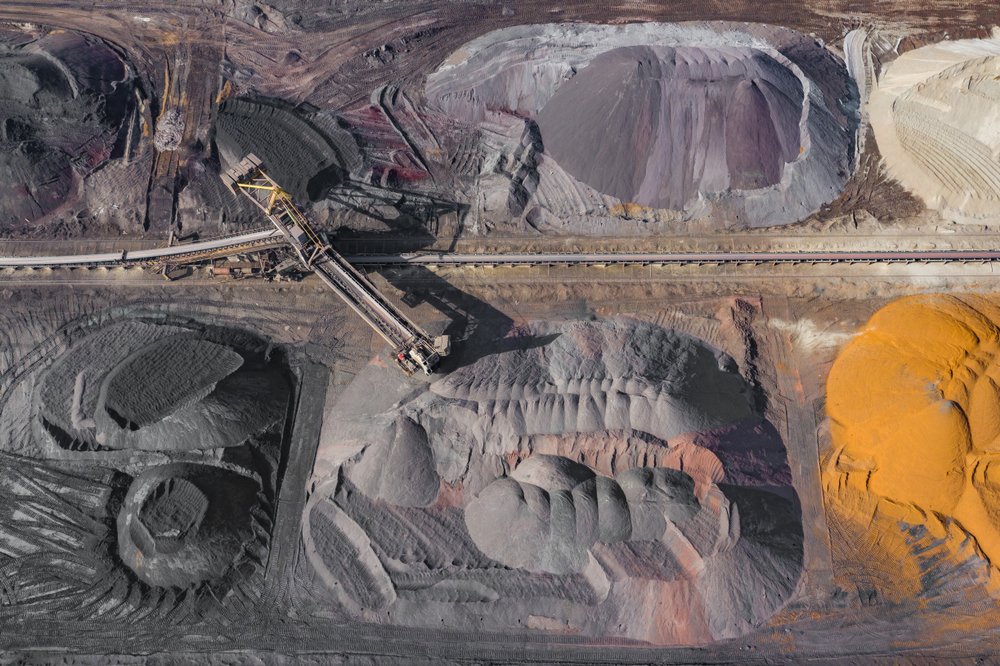

On the copper front, Q3's production rose from Q2, with Lumwana leading the charge. The copper cost of sales per pound for Q3 is estimated to be 5% to 7% less than Q2. C1 cash costs per pound are expected to drop by 9% to 11%. However, all-in sustaining costs per pound might rise by 2% to 4%, predominantly due to a spike in capitalized stripping at Lumwana.

Barrick plans to delve deeper into its Q3 2023 production and sales metrics during its official quarterly results announcement on November 2, 2023.

May also be interesting for you: "Weekly Metals News Digest"